- March 15,2023

Philip Morris stops exports to South Korea and Pakistan

An affiliate of Philip Morris Fortune Tobacco Corp. (PMFTC) Inc. has suspended its cigarette exports to two Asian countries due to the Philippine government’s tax stamp system.

Paul Riley, PMFTC president, said the governments of Pakistan and South Korea barred the entry of Philippine-made cigarettes due to the Bureau of Internal Revenue’s (BIR) tax stamp infused on every pack of cigarettes.

Riley explained the BIR requires Philip Morris Philippines Manufacturing Inc. (PMPMI) to affix the Philippine tax stamps on tobacco exports to South Korea and Pakistan, which account for about 1 percent of the company’s total output.

“The problem now is if you export to a country that does not have tax stamp, you’ll have to apply the Philippine tax stamp. That’s problematic because South Korea and Pakistan will not accept Filipino tax stamp on the product,” Riley told reporters.

“We have to stop producing, which is a shy because that’s export for the Philippines. [But] hopefully, that would be changed later,” he added.

To compensate for the losses in South Korea and Pakistan, Riley said PMPMI will increase its exports to other countries, including its biggest market Thailand.

Riley said exports to Thailand currently account for about 15 percent of PMPMI production volume.

Earlier, BIR Commissioner Kim S. Jacinto-Henares admitted that there were concerns on the implementation of Internal Revenue Stamps Integrated System (IRSIS), commonly known as tax stamp system, particularly in exports.

Jacinto-Henares, however, assured that the BIR will address the issues raised by cigarette manufacturers.

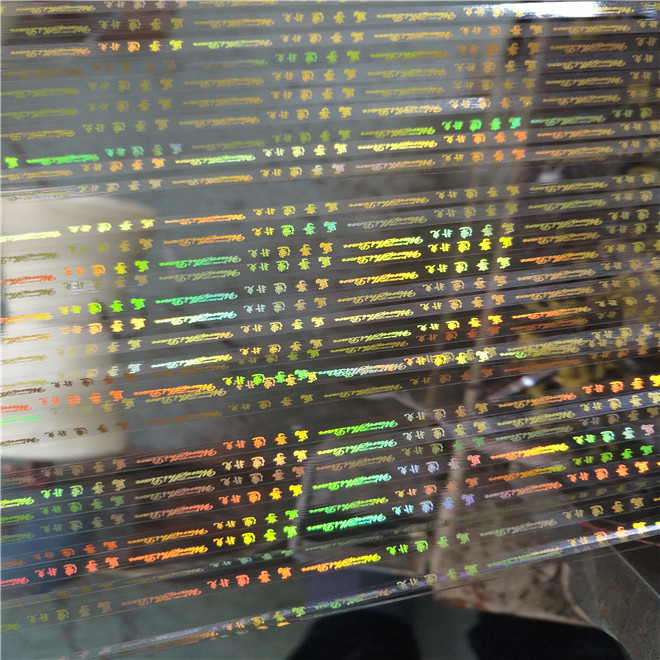

The BIR rolled out this year its long-delayed tax stamp scheme on cigarettes in a bid to minimize if not eliminate the proliferation of illicit cigarette brands in the domestic market.

Marlboro-cigarette maker and tobacco giant Philip Morris International had complained of increased illicit cigarette trade in the country, especially after the government implemented the Sin Tax Reform Law, which hiked excise tax rates on tobacco and alcohol products.

According to a recent report by the Senate Tax Study and Research Office (STSRO), there was some evidence of systematic and endemic fraud committed by one local cigarette manufacturing company.